23

2025

-

08

Development of the Film Industry under Environmental Protection Policies

Author:

Chinafilm Group

1. Introduction

Against the backdrop of an increasingly severe global environmental crisis, green and low-carbon development has become a broad consensus among governments, enterprises, and the public worldwide. With issues such as climate change, biodiversity degradation, and plastic pollution becoming more prominent, global environmental policies are increasingly impacting various industries in stricter ways. In this trend, the film industry, as a representative sector characterized by high energy consumption and pollution, is facing unprecedented challenges and transformation pressures.

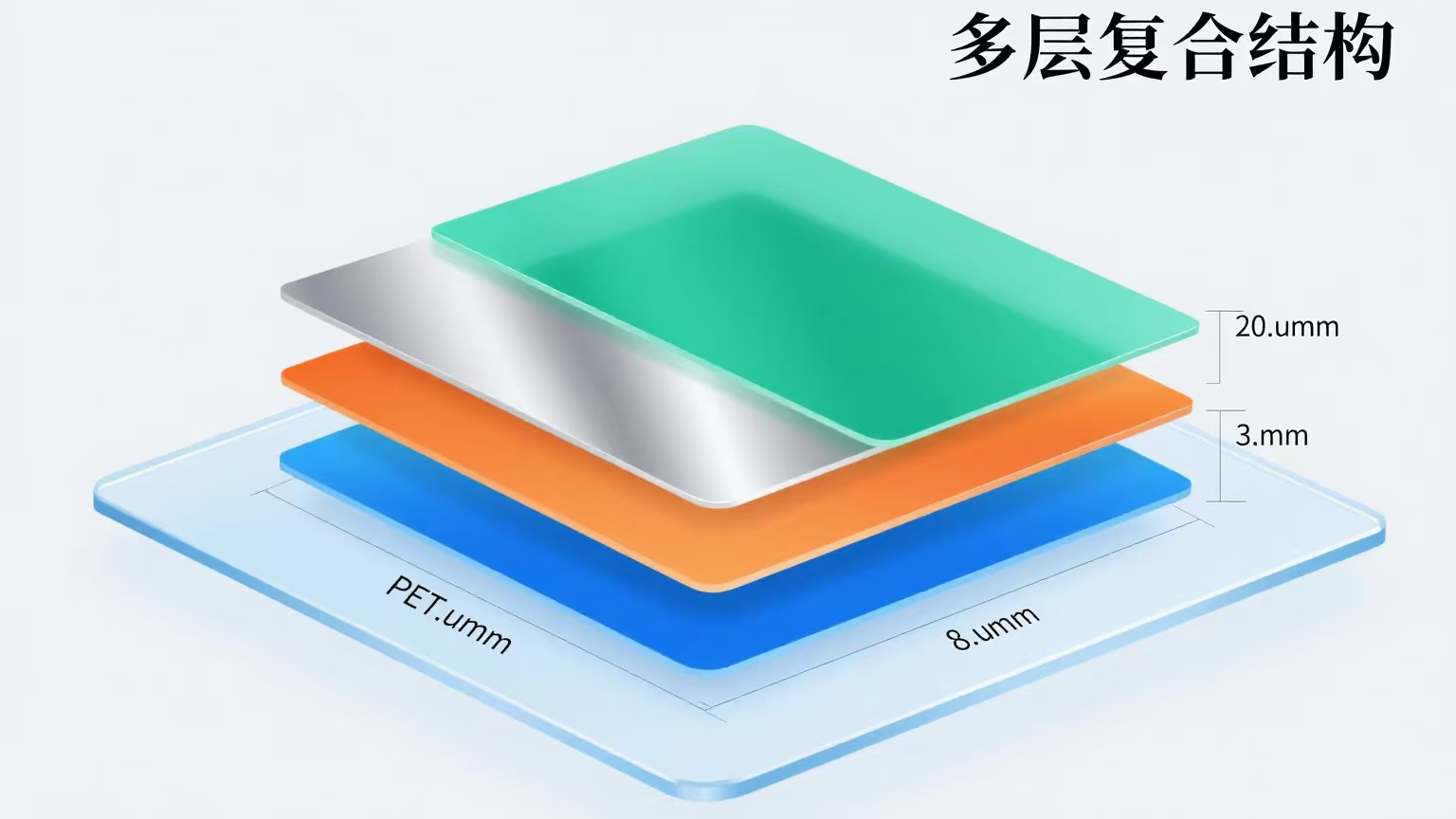

Film materials are widely used in food packaging, agriculture, medical, electronics, construction, and other fields, covering types such as polyethylene (PE), polypropylene (PP), polyester (PET), polyvinyl chloride (PVC), and their functional multilayer composites. Traditional films have been widely applied due to their low cost, high strength, and excellent barrier properties. However, the resulting white pollution, resource waste, and carbon emission pressures have made the film industry a key target for environmental policy regulation.

This article will start from global and Chinese environmental policies, deeply analyze the impact of environmental policies on the development of the film industry, dissect the challenges and opportunities enterprises face during transformation, and explore future trends and response paths for the film industry under the background of sustainable development.

2. Overview of Global and Chinese Environmental Policies

2.1 Major Global Environmental Policies and Action Plans

Major world economies have successively introduced environmental regulations to promote the green transformation of packaging materials:

- EU Green Deal Requires that by 2030 all plastic packaging must be recyclable or reusable; simultaneously bans single-use plastic products and establishes a carbon border adjustment mechanism;

- US Break Free From Plastic Pollution Act Establishes an Extended Producer Responsibility (EPR) system to promote comprehensive recycling and reuse;

- Japan Plastic Resource Circulation Promotion Act Implemented since 2022, promotes a full-process circular system for the design, production, use, and recycling of plastic products;

- Canada Plastic Ban Prohibits the manufacture and import of six types of single-use plastic products starting in 2023, promoting biodegradable packaging alternatives.

These policies share common features: raising environmental thresholds, promoting the use of recyclable and biodegradable materials, establishing producer responsibility systems, and reducing plastic pollution from the source.

2.2 Progress and Key Directions of Chinese Environmental Policies

China's environmental policy system has gradually shifted from "end-of-pipe treatment" to "whole lifecycle management," which is particularly significant for the film industry:

- 14th Five-Year Plan Plastic Pollution Control Action Plan (2021): Clearly proposes strengthening control over films in key areas such as agricultural films, express packaging, and food packaging;

- National Standard for Limiting Excessive Packaging of Goods (GB 23350): Restricts indicators such as number of layers, volume ratio, and void ratio to strictly control resource waste;

- Special Action Plan for Plastic Pollution Control Promotes innovation in alternative materials, strengthens recycling, and improves standards for recycled plastics;

- Carbon Peak and Carbon Neutrality Policy System Encourages enterprises to reduce carbon footprints through green manufacturing, energy saving and carbon reduction, and circular economy.

These policies are driving film enterprises to achieve green upgrades in material selection, product design, manufacturing processes, and recycling treatment.

3. Direct Impact of Environmental Policies on the Film Industry

3.1 Restrictions on Material Usage

Environmental policies restrict or prohibit the use of certain traditional non-degradable materials, especially in the field of single-use films such as shopping bags, express packaging, and agricultural mulch films. For example:

- PE Film Is banned in some cities for packaging uses in supermarkets and shopping malls;

- PVC Film Due to chlorine content and plasticizers, it poses potential environmental and health hazards and is banned in many countries;

- Composite Films Difficult to recycle and become environmental pollution risks; policies encourage switching to single recyclable materials.

3.2 Significant Increase in Compliance Costs for Enterprises

Implementation of environmental policies requires enterprises to replace materials, adjust production processes, retrofit equipment, and invest in environmental protection facilities:

- Raw material prices are generally 10%-50% higher than traditional plastics;

- Investment in retrofitting green production lines often reaches tens of millions;

- Emission compliance requires supporting waste gas treatment and wastewater recycling systems;

- Products must pass domestic and international environmental certifications such as ROHS, REACH, OK Compost, etc.

These costs translate into operational burdens, especially putting significant pressure on small and medium-sized film enterprises.

3.3 Reshaping of Market Competition Landscape

With rising environmental thresholds, enterprises unable to green transform are eliminated from the market. Meanwhile, a group of companies mastering eco-friendly materials and green processes rapidly rise to capture the high-end market. Large end customers such as Alibaba, JD.com, Procter & Gamble, and Unilever have made environmental protection an important supplier admission criterion, imposing higher sustainability requirements on film enterprises.

3.4 Promoting Circular Economy and Recycling Resource Utilization

Environmental policies emphasize the recycling and resource utilization of plastic films, encouraging:

- Construction of closed-loop systems ;

- Increasing the proportion of recycled materials in films ;

- Standardized labels, easy-tear designs, and single-material designs To improve recycling rates;

- Recycling incentive mechanisms such as "trade-in" and "deposit systems."

4. Responding to Challenges: Green Transformation Paths for Film Enterprises

4.1 Material Innovation: Moving Towards Biodegradable and Bio-based Materials

Environmental policies are driving innovation in material systems, and the following materials are accelerating commercial use:

Material Type | Main Characteristics | Application Scenarios |

PLA (Polylactic Acid) | Bio-based, biodegradable, good transparency | Food packaging, trays |

PBAT/PBS | Good flexibility, fast biodegradation | Garbage bags, courier bags |

Bio-based PE/PET | Partial replacement of petrochemical plastics, low carbon | Bottles, label films |

PVOH, water-soluble film | Water-soluble, biodegradable | Agricultural films, water treatment membranes |

Although these new materials cost more than traditional plastics, market acceptance is gradually increasing under environmental pressure and consumer support.

4.2 Process Upgrade: Building a Green Manufacturing System

Enterprises need to achieve green production processes through the following methods:

- Energy-saving and emission reduction technologies Such as replacing multi-layer coating with film co-extrusion to improve raw material utilization;

- Solvent-free lamination, water-based coating Replacing VOC-containing processes to reduce pollution emissions;

- Online inspection systems and automation equipment Improve yield rate and save resources;

- Thermal energy recovery system Recover and reuse exhaust heat to reduce energy consumption.

4.3 Establish Green Certification and Carbon Management Systems

To enhance market recognition and policy adaptability, enterprises need to:

- Obtain environmental management certifications such as ISO 14001, BRC, FSC, carbon footprint labels;

- Implement carbon emission quantification and establish product lifecycle carbon accounting systems (LCA);

- Participate in the formulation and pilot demonstration of domestic and international green product standards.

4.4 Recycling: Promote Full Product Lifecycle Management

Start from the design end to achieve recycling friendliness:

- Single material design Such as all-PE or all-PP structures, easy for mechanical recycling;

- Removable labels Improve backend recycling and cleaning efficiency;

- Product traceability system Track film lifecycle through QR codes, chips, etc.;

- Use of recycled materials Promote closed-loop reproduction to reduce virgin resin consumption.

5. Environmental Film Market Development Trends

5.1 High-growth Track: Biodegradable Packaging Films

According to relevant institutions, the global biodegradable plastic film market size will reach 15 billion USD by 2025, with an annual growth rate exceeding 15%. Food packaging, takeout, express delivery, and supermarket shopping bags are the main application scenarios, driven mainly by policies and consumer environmental awareness.

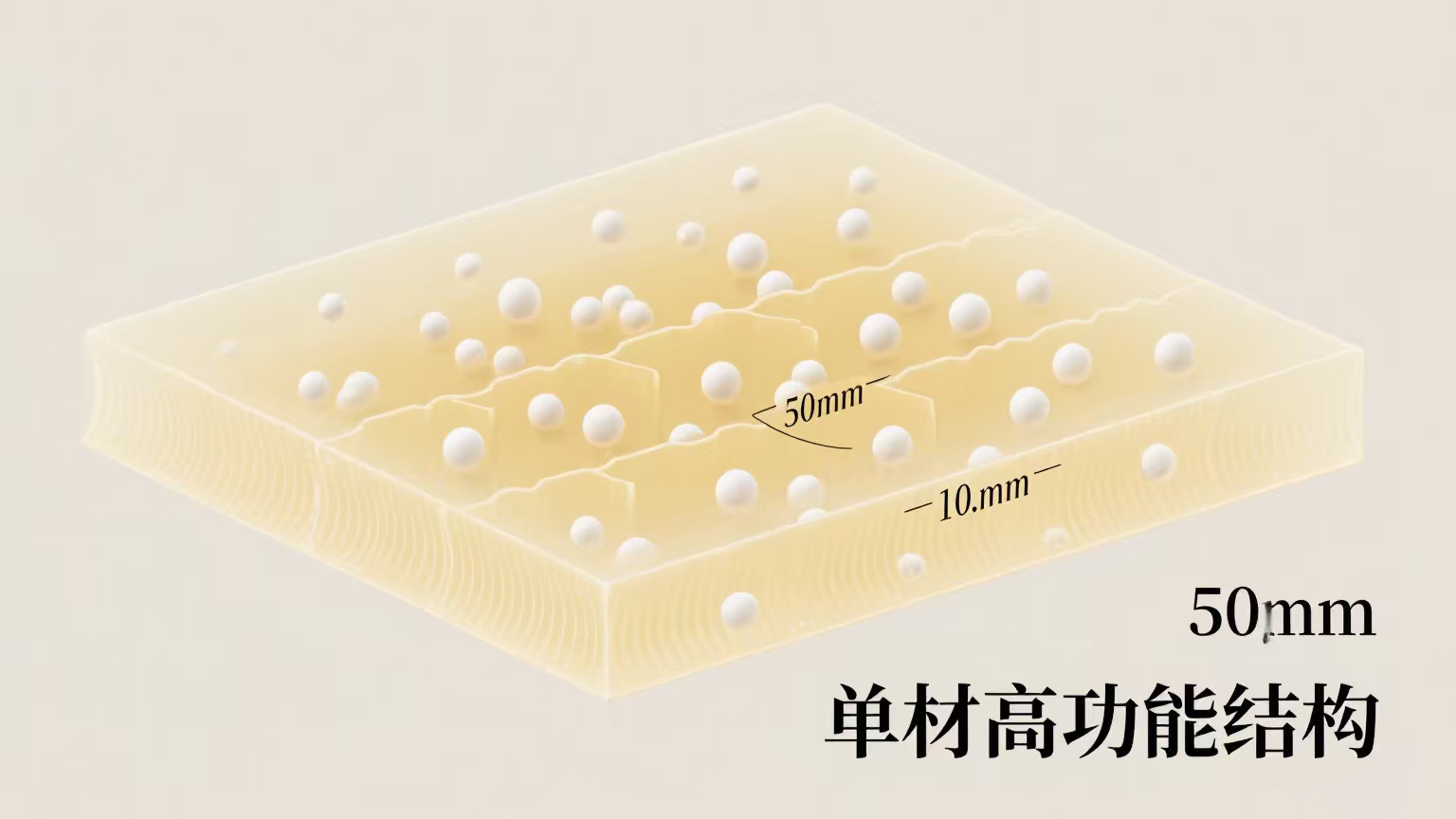

5.2 Structural Reshaping: Shift from "Multi-layer Composite" to "Single Material High Functionality"

In the future, film structure design will aim for "no loss of function, recycling friendliness":

- Use high barrier coatings such as EVOH, SiOx, AlOx to replace aluminum foil;

- Develop single-material films integrating heat sealing, oxygen barrier, UV resistance functions;

- Use peelable intermediate layers to facilitate separation of composite films during recycling.

5.3 Regional Market Differentiation Intensifies

- Europe, America, Japan markets Strict regulations, high requirements for green films, suitable for high-end eco-friendly materials and certified enterprises;

- Asia, Africa, Latin America markets Relatively relaxed environmental policies, high price sensitivity, but large potential market space;

- China market Currently in a transition period, policy-driven combined with consumption upgrade, dual drivers promote the rise of eco-friendly films.

5.4 Accelerated Integration of Digitalization and Intelligent Manufacturing

With the help of industrial internet and AI, many film manufacturers achieve:

- Digital raw material tracking and carbon emission monitoring;

- Intelligent formula design and process control;

- Quality prediction and energy consumption optimization based on big data;

- Digital product labels help consumers identify green products.

6. Typical Enterprise Green Transformation Case Studies

Case 1: Germany BASF launches ecovio® series biodegradable films

BASF developed the eco-friendly biodegradable film "ecovio®" based on PLA+PBAT blending technology, widely used in:

- Food packaging films;

- Biodegradable garbage bags;

- Agricultural mulch films (completely degrade in soil within 180 days).

Its products are certified by EN13432, supported by LCA data providing carbon footprint information, and have entered multiple countries' eco-friendly packaging markets.

Case 2: Japan Mitsui Chemicals develops high-barrier recyclable films

To comply with the "Resource Circulation Law," Mitsui Chemicals launched various single-material structures, such as:

- Transparent High Barrier PE Film : Used for frozen food and prepared food packaging;

- Recyclable PP Oxygen Barrier Film : Used for daily cosmetics flexible packaging.

Its products meet packaging functional requirements and can enter existing recycling systems, gaining high market recognition.

7. Challenges and Policy Recommendations

7.1 Large Fluctuations in Raw Material Prices, Limited Market Acceptance

Supply of biodegradable and environmentally friendly materials is limited, with high prices. It is recommended that the government increase support for the green raw material industry chain and expand capacity to reduce costs.

7.2 Lack of Unified Recycling and Treatment System

Film products have large volume, low value, and strong dispersion, with insufficient recycling willingness and system construction. A dedicated recycling subsidy mechanism should be established to enhance incentives for consumers' environmental behavior.

7.3 Incomplete Standard System

Currently, various environmental material and product standards are missing or inconsistent, affecting market trust. Accelerating the formulation of national standards, testing methods, and labeling certification systems for eco-friendly films is necessary.

7.4 Insufficient Investment in Technology R&D

Eco-friendly films involve multidisciplinary intersections of materials, equipment, and processes, requiring long-term technological accumulation. It is recommended that the government support enterprise R&D innovation through special science and technology projects, industrial funds, and industry-university-research cooperation.

8. Conclusion: Towards a Sustainable Future

The deepening implementation of environmental policies brings profound changes to the film industry. Despite challenges such as rising raw material costs, process upgrade difficulties, and long market adaptation periods, eco-friendly films also nurture huge market dividends and development opportunities.

Only by actively responding and undergoing green transformation across the entire chain—from materials, processes, recycling, to management—can enterprises stand undefeated in the global green wave. The future film industry will no longer be synonymous with "packaging" but will represent green, intelligent, and sustainable modern manufacturing.

Environmental Protection,Industry,Policy,Suggestion

Latest News

2025-10-06

Mid-Autumn Festival, filled with moonlight—A heartfelt message to Chinafilm family members on this special occasion

Mid-Autumn Greetings to Chinafilm Family

2025-10-01

A Glorious National Day Celebration: Membrane Power, Together

Chinafilm Group's National Day Tribute

2025-09-26

Wrap Film vs. Protective Film: Stop the Confusion—One Article Clearly Explains the Key Differences

In the fields of packaging, transportation, and product protection, "stretch film" and "protective film" are often confused—and even casually interchanged during use—leading to issues such as goods scattering or products getting scratched. In fact, these two types have vastly different design intentions, functional characteristics, and application scenarios. This article will break down their distinctions across 8 key dimensions, helping you quickly identify the differences and make the right selection every time.

2025-09-24

Under the wave of packaging automation, film products need to unlock these new features.

As core materials in the packaging process, the performance of film products directly influences the efficiency, stability, and quality of automated packaging. Under this trend, film products must proactively adapt to the demands of automation equipment while unlocking even more innovative features.

2025-09-20

What are the storage conditions for different membrane products? How do temperature and humidity affect their shelf life?

Different types of films have vastly varying storage requirements for temperature and humidity due to differences in materials and manufacturing processes. This article will break down the specific storage conditions for common film types, as well as explain the precise impact of temperature and humidity deviations on shelf life.