15

2025

-

08

Special Film Market: Growth and Innovation

Author:

Chinafilm Group

I. Introduction: The Era of "Membrane" from Functional Materials to System Support

In the new round of global science and technology industry competition, materials have become the key to "bottleneck". As the pearl on the crown of material technology, special films have the characteristics of lightness, thinness, flexibility, high performance, and high added value. They are widely used in packaging, electronics, energy, medical, aviation, construction and other fields, and are the bridge connecting the underlying material science and terminal industrialization.

Special films have been transformed from auxiliary materials with single barrier and packaging functions to "smart components" integrating structural support, signal conduction, energy conversion, and environmental response. Its market growth not only depends on basic consumer goods, but also connects with national strategic emerging industries such as new energy vehicles, flexible displays, medical equipment, and green energy. This article will comprehensively analyze its market logic, technological evolution, key applications, innovation paths, and global industrial landscape, providing a systematic reference for insight into its future development strategy.

II. Industry Structure: Film Technology System and Classification Dimensions

2.1 Technical Essence

The core attributes of special films lie in "structural fineness" and "functional empowerment". These two cores determine that it can be used in extreme working conditions and complex environments, and is an important basic support in the field of high value-added manufacturing. Special films achieve performance advancement in the following ways:

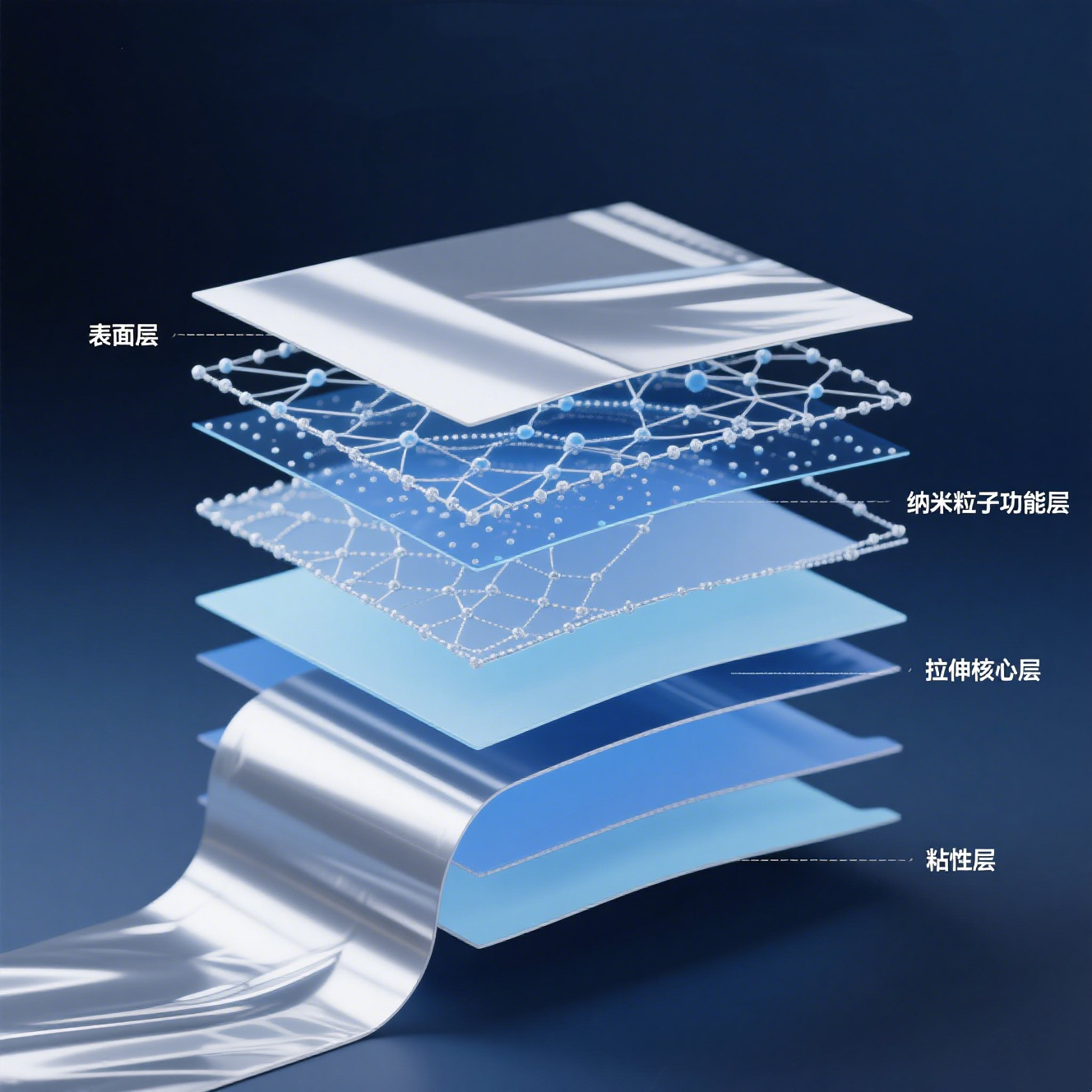

- Nanometer-level thickness control : Can meet optical precision requirements and extreme flexibility needs;

- Multi-layer co-extrusion/composite configuration : Different layer functions can be designed as needed, such as barrier layer, wear-resistant layer, and heat-sealing layer;

- Functional filler addition : For example, adding aluminum oxide, boron nitride, silver nanowires, etc. to improve thermal conductivity/electrical conductivity/bacteriostatic performance;

- Surface chemical/physical treatment : Improve printability, adhesion and surface energy through plasma, corona, spraying and other methods.

These technologies have transformed special films from "protective materials" to "intelligent support platforms", providing a core foundation for modern electronics, energy and medical care.

2.2 Classification Logic

By material source:

- Petrochemicals : PET has good mechanical properties and transparency, PI has excellent heat resistance, while PEEK/PTFE provides electrical insulation or chemical corrosion resistance in extreme environments;

- Biological : PLA, PBS, etc. are derived from renewable resources, and the degradation cycle is controllable, which is in line with ESG policy guidance;

- Hybrid system : Such as organic/inorganic composite materials combine rigid and flexible structures, taking into account mechanical strength and ductility.

By function type:

Function type | Technical features and uses |

High barrier film | Usually used in packaging, it can effectively block the penetration of O₂, CO₂ and H₂O and improve freshness |

Optical film | Used in OLED displays, AR/VR optical waveguide systems, requiring extremely low haze and high light transmittance |

Conductive/thermal film | Used in wearable devices, flexible circuits, heat dissipation layers or electromagnetic shielding layers |

Medical protective film | Used in surgical scenarios and wound dressings, it needs to be antibacterial, breathable, and prevent liquid penetration |

Encapsulation film | Used for lamination protection of lithium battery/solar modules, providing moisture-proof and crack-resistant capabilities |

Intelligent response film | It has advanced functions such as thermochromism, moisture response, and stress-induced luminescence, and can be used in human-computer interface materials in the future |

III. Analysis of Global Market Trends

The global special film market is in a stage of rapid development. According to forecasts by MarketsandMarkets, Allied Market Research and other institutions, the global market size in 2023 will be approximately US$46 billion, and is expected to reach more than US$75 billion by 2030, with an average annual growth rate (CAGR) remaining above 8%. The key factors driving this growth include:

- The outbreak of new energy drives the rapid growth of functional films : Lithium battery separators and photovoltaic encapsulation films have become the largest incremental markets;

- Sustainable development policies promote the application of degradable films and recyclable structural films : Europe and the United States have imposed restrictions on non-recyclable composite films, promoting the penetration of alternative materials such as EVOH, PLA, and PBS;

- Upgrading of electronic products and accelerated application of flexible technology : The demand for transparent PI film and optical conductive film has increased significantly;

- Medical protection and intelligent biological film technology are becoming increasingly mature : Antibacterial films, adaptive dressings, and wearable monitoring films are rapidly being promoted;

In addition, the development of 5G, AI, the Internet of Things and wearable medical devices has provided new tracks for functional films. For example, high-frequency communication equipment has higher requirements for electromagnetic shielding and heat dissipation films, and stretchable transparent conductive films have been gradually deployed in electronic skins and smart clothing.

The Asia-Pacific region, especially China, Japan, and South Korea, has become the largest production and consumption market, accounting for more than 45% of the global market share. North America has technological advantages in medical films, aviation films, and smart material films, while Europe is in a leading position in green regulations and material standards.

IV. Breakthroughs in Advanced Equipment and Intelligent Manufacturing Technology

As the demand for functional films tends to be high-performance and multi-functional, its production equipment has also entered the stage of precision, automation and intelligence.

- High-speed co-extrusion equipment : Adopting 5

7-layer co-extrusion technology, with 6001000m/min production capacity, widely used in the production of barrier films and encapsulation films; - Intelligent Tension Control System : Ensures thickness uniformity, surface finish, and edge stability through closed-loop control and AI feedback algorithms;

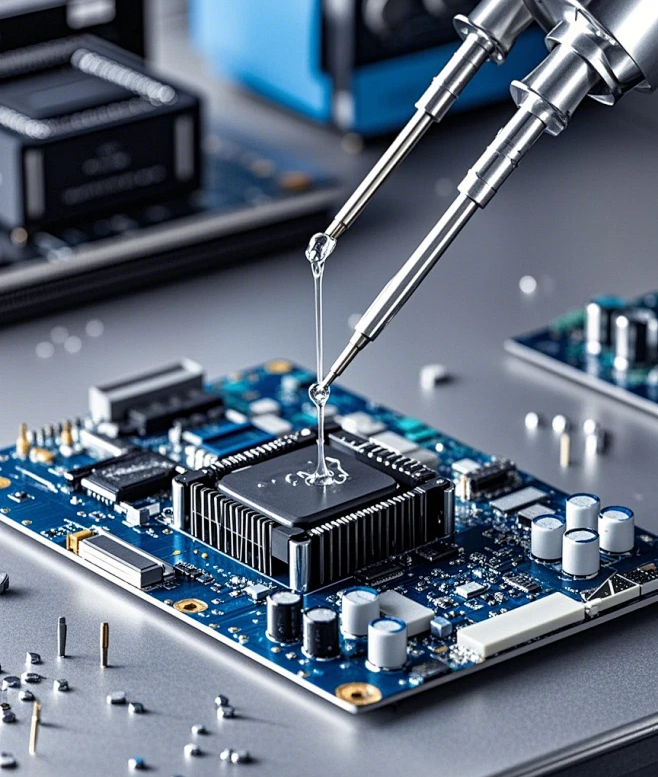

- Digital Precision Coating Platform : Supports multi-functional area coating, such as thermal conduction, electrical conduction, anti-fog, anti-bacterial, and other functional segmented directional film application;

- AI Detection and Defect Recognition System : Real-time identification of pinholes, streaks, color differences, thickness fluctuations, etc. during the film-making process to improve product consistency and yield;

In addition, Digital Twin technology is beginning to be introduced into membrane material production. By constructing a virtual membrane material production line model, the influence of variables such as temperature, draw ratio, and pressure on membrane material performance can be simulated, thereby achieving rapid process optimization. The cloud-based equipment collaboration system also improves remote operation and maintenance efficiency, promoting the upgrade of equipment from "automation" to "intelligence."

Domestic equipment manufacturers are also accelerating the pace of import substitution. Some high-end stretching equipment and electronic coating lines have been independently developed, providing conditions for the large-scale production of new membrane types and solving the problem of dependence on imported core equipment.

V. Policy Guidance and Industrial Support Paths

Governments and regional organizations around the world attach great importance to the development of high-performance membrane materials, regarding them as an important foundation for supporting new energy, green packaging, and intelligent manufacturing. Typical policies include:

- China's "14th Five-Year Plan" for New Materials : Clearly proposes to accelerate the development of high-performance membrane materials and key supporting devices, and encourages the formation of a closed industrial chain;

- EU Circular Economy Act : Restricts the use of non-recyclable membrane materials such as PVDC, and promotes the development of functional membranes towards a single-structure, high-barrier direction;

- US Department of Energy and FDA Cooperation Mechanism : Supports performance testing standardization and product certification for medical membranes, packaging membranes, and sensing membranes;

- South Korea's "Material, Parts, and Equipment Powerhouse Plan" : Supports the realization of domestic independent supply of lithium battery separators, PI films, and OLED encapsulation films;

In addition, many countries and regions have introduced green factory certification systems, providing policy bonuses and subsidies to membrane material companies that use low-VOC emissions, biodegradable materials, and high-energy-efficiency equipment. R&D also receives special funding, encouraging overall technological upgrades from basic formulas and process equipment to film-forming logic.

In the future, the government will increase support in the following areas:

- Establish a national-level "Advanced Functional Membrane Materials Engineering Center" , as a technology research and industrial incubation platform;

- Promote legislation on membrane material recycling and classification , and formulate classification labels and subsidy mechanisms for recyclable and biodegradable membranes;

- Encourage the membrane material field and terminal applications to jointly build a "Collaborative Innovation Center" , forming a new path for application feedback to drive R&D;

- Support enterprises to participate in the formulation of international standards and global green trade rule negotiations , and enhance global influence.

VI. Supply Chain Security and Downstream Application Scenario Expansion

6.1 Global Supply Chain Stability Challenges

The specialty film industry is highly dependent on high-purity raw materials, precision equipment, and specialized technical personnel. Its supply chain spans multiple industries such as chemicals, materials, machinery, and electronics. Once a link is blocked, it may have a significant impact on the entire chain. In recent years, affected by geopolitical conflicts, repeated epidemics, logistics fluctuations, and rising energy prices, the stability of the global specialty film supply chain has been impacted.

Specific challenges include:

- High-end resin raw materials (such as PI monomers, PEN) still rely on imports , especially in Japan and Germany, which control the core formulas;

- High-precision film equipment (such as five-axis stretching machines, electronic coating systems) still mainly comes from European, American, Japanese, and Korean manufacturers ;

- The prices of some functional additives (such as light stabilizers, conductive fillers) fluctuate sharply, affecting production costs;

- Increased export controls and trade barriers , affecting the free flow between some countries;

To this end, leading companies are strengthening the following strategies:

- Establish a joint R&D system of "raw materials + additives + process + equipment" to achieve domestic substitution of materials;

- Deploy multi-regional production capacity distribution to reduce dependence on a single country;

- Introduce blockchain and smart label technology to build a transparent and traceable supply chain tracking system;

6.2 Expansion of Typical Downstream Applications

The application of specialty films is accelerating from the traditional "packaging, protection" to "participating in function realization."

(1) Electronic Information Industry

- OLED screens use ultra-thin flexible PI film instead of glass as a substrate;

- VR/AR devices use high-transparency, low-haze optical films for waveguide coupling;

- Mobile phones and wearable devices use electromagnetic shielding films and thermal conductive films to enhance signal and heat dissipation performance.

(2) New Energy Industry

- The lithium battery industry uses ceramic-coated PE film and double-sided stretched film to improve thermal stability and safety;

- POE encapsulation films in the photovoltaic industry have higher PID resistance and UV weather resistance;

- Hydrogen energy systems require thin, high-barrier films to achieve hydrogen storage and transportation and reaction chamber protection.

(3) Medical and Health Field

- Biodegradable antibacterial films are used as biological dressings for surgical operations and wound repair;

- Microporous membranes are used for key media membrane components such as drug filtration, dialysis membranes, and artificial lung membranes;

- "Close-fitting" wearable medical devices are beginning to adopt flexible intelligent response films in batches.

(4) Architecture and Environmental Engineering

- Architectural glass film achieves multiple functions such as explosion-proof, UV protection, and heat reflection.

- The demand for flame-retardant encapsulation film and spray protective film is increasing in subway tunnels and rail transit fields.

- Ultrafiltration membranes and reverse osmosis membranes are increasingly critical in sewage treatment and high-end water filtration systems.

VII. Typical Companies and Case Studies

7.1 Representative Domestic Enterprises

- Ningbo Jintian : Covers the entire series of PET, PE, and functional coating films, serving photovoltaic, logistics, and daily chemical packaging.

- Tiannai Technology : Focuses on the development of nano-composite functional films, serving lithium batteries, aviation, and high-end electronic modules.

- Putailai : Provides integrated lithium battery separator solutions for BYD and CATL.

7.2 Leading International Companies

- SK IE Technology (South Korea) : Leading lithium battery separator, with the highest global market share.

- 3M (USA) : Has a wide layout in medical, optical film, protective film and other directions.

- Toray (Japan) : Has the integrated capability of PI, PET, PEN and other materials from raw materials to film making.

7.3 Successful Cases

- A leading domestic electronic brand and film manufacturer jointly developed a foldable screen PI film , successfully realized the domestic substitution of original glass modules, with high transparency, high wear resistance and low radius of curvature characteristics.

- A medical antibacterial film company established a joint laboratory with a hospital , to achieve rapid iteration from basic research and development to clinical adaptation, and promote the entry of antiviral membranes into medical terminal systems.

VIII. Conclusion: Grasp the Innovative Pulse of the Membrane Era

Special film is the strategic core of the high-performance material system and the binder for cross-industry integrated innovation. It is no longer just a passive "packaging material", but a system core node that runs through intelligent sensing, energy conversion, health protection, and structural protection. Mastering the innovation path of special films means mastering the dominant power of future advanced manufacturing, green industry, medical health, and intelligent equipment.

The future belongs to those leaders who deeply cultivate the foundation of materials, coordinate the industrial ecology, and integrate technological boundaries.

Previous

Previous

Latest News

2025-08-15

Special Film Market: Growth and Innovation

Chinafilm Group will comprehensively analyze the logic, technological evolution, key applications, innovation paths, and global industrial landscape of the special film market, providing a systematic reference for understanding its future development strategy.

2025-08-13

Printing and adhesive technology of label films

Chinafilm Group will systematically explore the mainstream printing processes, technological trends, and adhesive structure and control methods of label films. Combining application cases, it will present a complete picture of this seemingly small yet highly engineered material system.

2025-08-09

Label film: Small label, big effect

With the accelerating trend of digitalization, greening, and high-end packaging, the performance requirements of label films are increasing, and their application scenarios are becoming increasingly broader and more specialized. This article will systematically introduce the main types of label films and in-depth analyze their typical applications and technical adaptation strategies in different industries, allowing you to fully understand the "great role behind this small label".

2025-08-07

**Start of Autumn: Expect Steady Winds While Heat Persists—Be Alert**

Liqiu arrives as scheduled. It originates from the ancients' observations of the celestial phenomena and is closely related to farming. But don't think that Liqiu marks the end of the scorching heat; the "autumn tiger" may still be lurking. Want to know how to adapt to the season and nurture your body and mind during Liqiu? This article provides a detailed explanation.

2025-08-05

Applications of nanotechnology in thin films

Chinafilm Group aims to systematically analyze the typical application mechanisms and performance improvement pathways of nanotechnology in thin films. Combining case studies and data analysis, it explores its broad prospects in various industries.